fulton county ga property tax sales

The Fulton County Tax Commissioner is responsible for the collection of Property. What is the sales tax rate in Fulton County.

Fulton County Tax Commissioner

Duties And Responsibilities Of Fulton County Tax Offices.

. Sales Use Taxes Fees Excise Taxes. 0 Campbellton Fairburn Road South Fulton Georgia 30213. This rate includes any state county city and local sales taxes.

DeKalb County contains about 10 of Atlantas. November 15 Atlanta Solid Waste E-911. Property Tax Sales Fieri Facias FiFa Authority To Sell.

The Supreme Court Ruling on TADs. 2020 rates included for use while preparing your income tax. The Fulton County Board of Assessors reserves the right when circumstances warrant to take an additional 180 days pursuant to OCGA.

The Fulton County Tax Commissioner is responsible for collecting property taxes on behalf of Fulton County Government two school systems and some city governments. Fulton County collects on average 108 of a propertys assessed. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties.

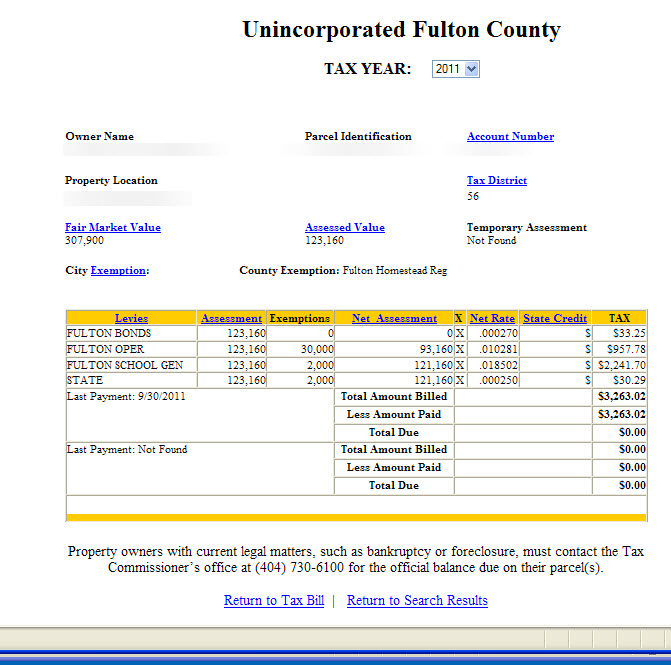

It reduces the assessed value of a home by 10000 for county taxes 4000 for school taxes and 7000 for recreation taxes. The median property tax in Fulton County Georgia is 2733 per year for a home worth the median value of 253100. Issuance and FiFa Recordation.

0 Campbellton Fairburn Road South Fulton Georgia. Tax Sales are held on the first Tuesday of each month between the hours of 10 am and 4 pm on the steps of the Fulton County Courthouse 136 Pryor Street SW except. October 15 Johns Creek Stormwater.

141 Pryor Street SW. After the tax sale if there are any excess funds generated from the sale of. October 31 Fulton County.

Ending tax on tags would be fairer to all. Fulton County GA currently has 3636 tax liens available as of October 12. Ferdinand is elected by the voters of Fulton County.

Tax Allocation Districts in Fulton County. Atlanta Georgia 30303-3487. The latest sales tax rate for Fulton County GA.

The minimum combined 2022 sales tax rate for Fulton County Georgia is. Fulton County has one of the highest median property taxes in the United States and is. Surplus Real Estate for Sale Read More tax refund after lien sale Read More property and vehicles.

This is the total of state and county sales tax rates. 48-5-311 e 3 B to review the appeal of. OFfice of the Tax Commissioner.

Tax Commissioner Arthur E Ferdinand 141 Pryor Street SW Suite 1085 Atlanta GA 30303 Phone. Infrastructure For All. Fulton County lewis slaton courthouse Plats and Lands.

Fulton County Initiatives Fulton County Initiatives. Fulton County Tax Commissioner Dr. Local state and federal government websites often end in gov.

Property Tax Sales Fieri Facias FiFa Authority To Sell. The Fulton County Georgia sales tax is 775 consisting of 400 Georgia state sales tax and 375 Fulton County local sales taxesThe local sales tax consists of a 300 county sales tax. State of Georgia government websites and email systems use georgiagov or gagov at the end of the address.

Fulton Countys tax rate lies at approximately 108 slightly above the national. Fulton County Tax Sale-Bidder Registration Bidder Information. Fulton County collects on average 108 of a propertys assessed fair market value as property tax.

Property Tax - City of Atlanta. A TAX SALE IS THE SALE OF A TAX LIEN BY A GOVERNMENTAL ENTITY FOR UNPAID PROPERTY TAXES BY THE PROPERTYS OWNER. If you need access to a database of all Georgia local sales tax rates visit the sales tax data page.

Fulton County Sheriffs Tax Sales are held on the first. Boasting a population of nearly 11 million Fulton County is Georgias most populous county.

Johns Creek Local Option Sales Tax

Treasurer Fulton County Oh Official Website

South Fulton Ga Land For Sale Real Estate Realtor Com

Fulton County Property Tax Assessments Have Been Issued Here S What You Can Do Next 11alive Com

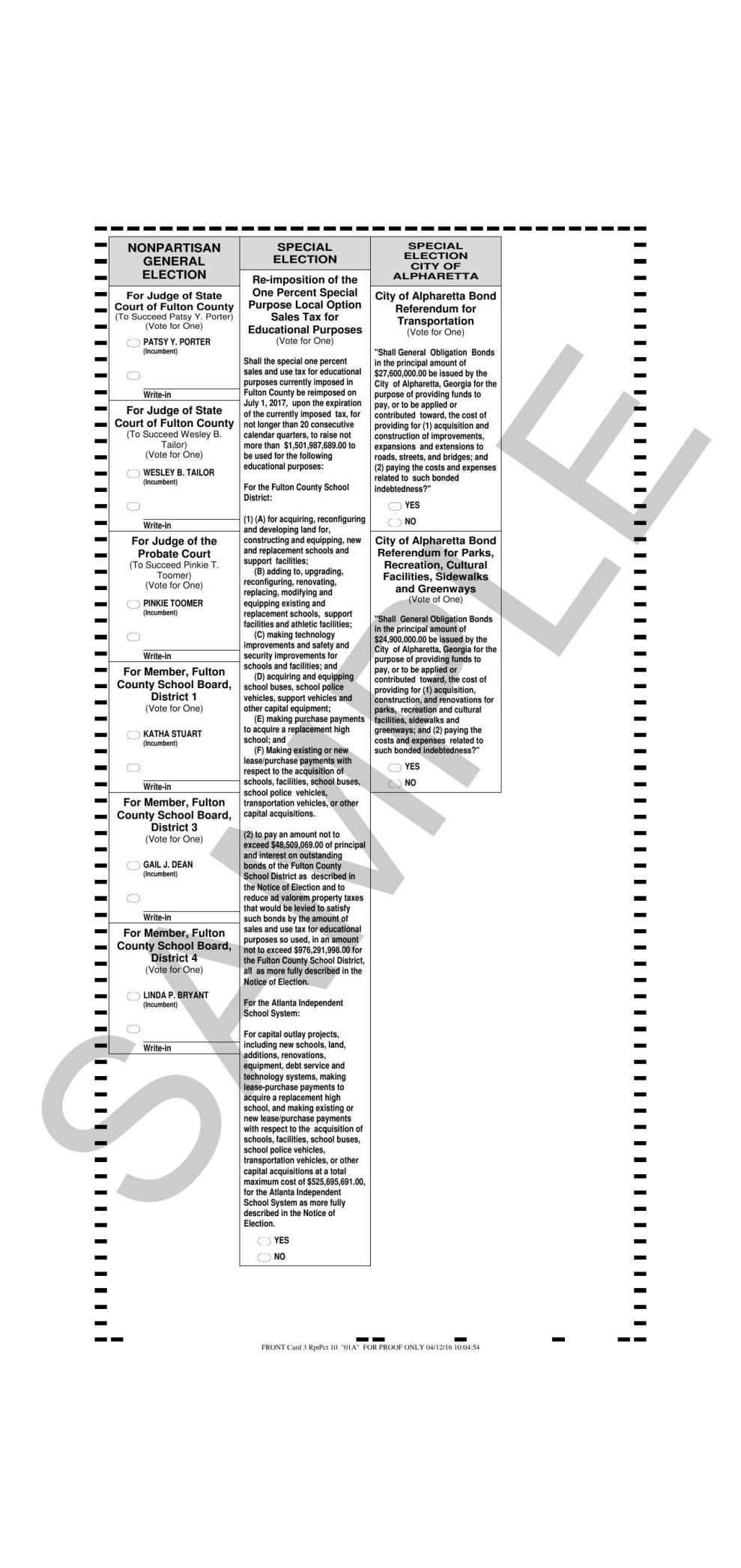

May 24 Primary Election Fulton County Republican Sample Ballot 2 Documents Mdjonline Com

![]()

Atlanta Georgia Property Tax Calculator Fulton County Millage Rate Homestead Exemptions

B O E Fulton County Superior Court Ga

Atlanta Georgia Property Tax Calculator Fulton County Millage Rate Homestead Exemptions

Milton Georgia Property Tax Calculator Millage Rate Homestead Exemptions

Fulton County Georgia New Energy And A New Mission Aim To Complete The Picture In Greater Metro Atlanta Site Selection Online

Fulton County Georgia Va Property Information Va Hlc

Atlanta Relocation Schools And Education Private Christian Lutheran Tutors

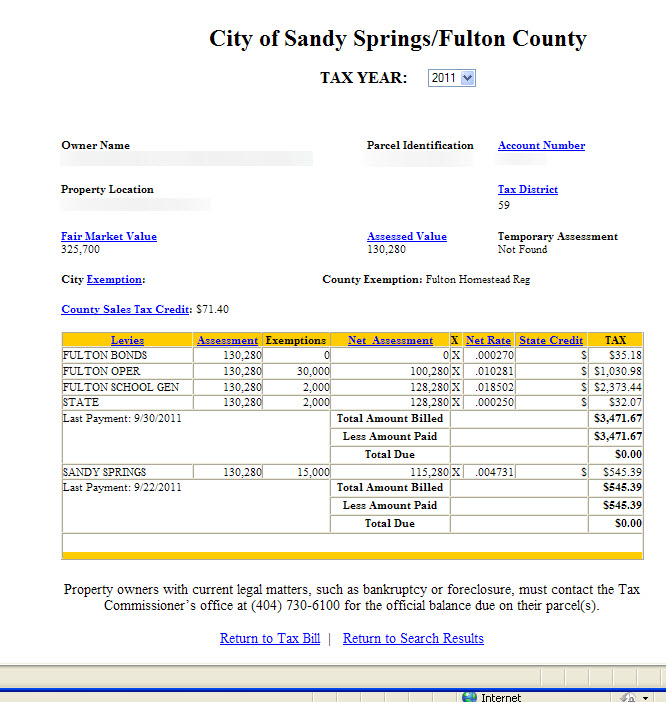

Sandy Springs Georgia Property Tax Calculator Millage Rate Homestead Exemptions

Johns Creek Local Option Sales Tax